于CFA协会®考试报名的营业税费

根据CFA协会®规定,自2011年2月16日起,凡中国区考生在注册报名参加CFA®考试时(包括新考生和老考生),CFA协会®将会依据所需缴纳的注册费和考试费按3%的比例加收营业税费(Business Tax),同时还将根据所需要缴纳的营业税费按7%的比例加收城市建设和维护费(Urban Construction and Maintenance Tax)及按3%的比例加收教育附加费(Education Surcharge)。营业税费、城市建设和维护费和教育附加费在考生注册报名时会自动增加,由CFA协会®代为收取并缴纳给中国税务机关。

以下是各种情况所增加税费的情况:

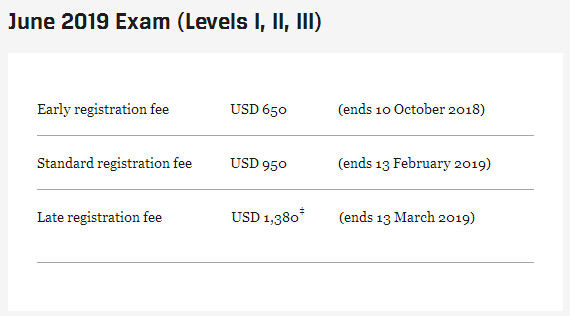

》》CFA考试费用报名时间

CFA协会®原文:

Tax Policy

Tax shown on purchase receipt refers to tax collected by CFA Institute and not necessarily tax due to state and local taxing agencies. Customers may be individually subject to tax for purchases where CFA Institute does not collect tax. Customers should contact their local tax adviser regarding the taxability of their online purchase if they are uncertain about their tax liability related to this purchase.

Residents of the United States:

Residents of VA, GA, IA, TX, IL, MA, WI, NY, NJ, and PA may be charged sales tax depending upon the taxability of the specific product purchased.

Colorado residents are liable for use tax for online purchases of taxable products and/or services delivered to Colorado. Please consult your personal tax adviser or the Colorado Department of Revenue for additional information regarding your use tax liability.

Outside the United States:

International sales and conference registration fees may be subject to applicable VAT and GST.

The CFA Institute Canadian business number for GST is 12413 4602 RT0001.

Chinese residents are subject to the Chinese Business Tax, Urban Construction and Maintenance Tax, and Education Surcharge on certain services. Tax rates for the Business Tax are three percent for the exam enrollment fee and exam registration fees and five percent for membership

dues and conference fees. Tax rates for the Urban Construction and Maintenance Tax and Education Surcharge are seven percent and three percent on Business Tax liability, respectively.