同学们,同学们

二级第二天的《高频知识》新鲜出炉了!

今天你押对宝了没?

还是展示一遍征集来的一手信息

一定完整要看(读)一遍哦,

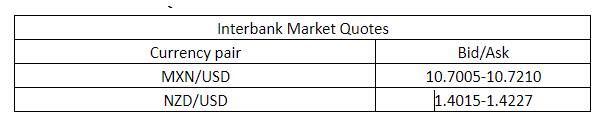

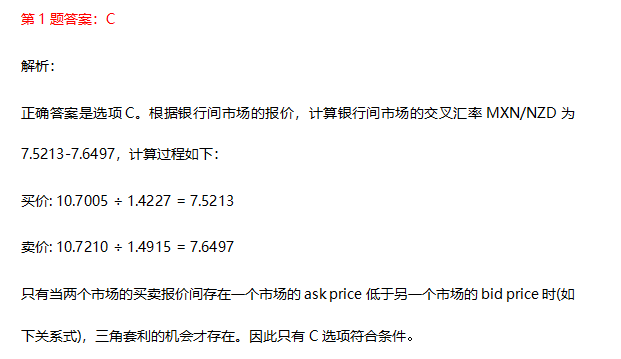

知识点1:三角套利

关联科目及章节:经济-R6-外汇汇率

考点介绍:

若不同市场的外汇报价不同,则可能存在套利机会。此时,投资者可以通过对比做市商和当前银行间市场的报价,判断是否存在套利机会。

知识复习:

计算步骤:①根据银行间市场的报价求出价差汇率;②将计算出的交叉汇率与题目已知的做市商的报价比较;③当做市商与银行间的报价区间不相交的时候。

相关习题:

Michael is a professional FX trader,based in New York.He observed the current quotes of the interbank market are as following:

Interbank Market Quotes

Which of the following three dealers offers the quote most likely to make triangular arbitrage trade possible?

A.Dealer 1:7.6048/7.6512 in MXN/NZD.

B.Dealer 2:7.5109/7.6601 in MXN/NZD.

C.Dealer 3:7.6500/7.6528 in MXN/NZ

查看答案+详细解析

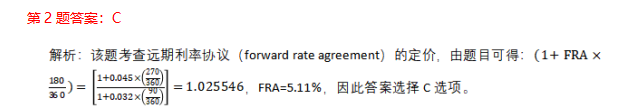

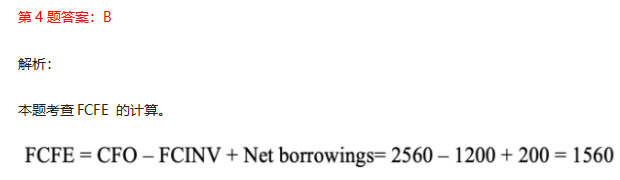

知识点2:远期利率协议

关联科目及章节:衍生-R33-远期承诺的定价与估值

考点介绍:

与一般衍生品不同,FRA的标的资产并不是金融资产而是双方买卖过程中的利息支付。在二级考试中比较容易考查计算,同学务必掌握。

知识复习:

FRA的合同价格(forward price)本质上就是远期利率(forward rate),对于一份“1×4 FRA”来说,合同利率适用的期间为“从1个月后开始,到第4个月结束”,对应的远期利率就是从1个月后开始、期限为3个月的远期利率。

FRA合同采用现金结算(cash settlement),多头和空头之间并没有发生真实的借贷关系,在FRA合同到期时,仅仅由一方向另一方支付利息差额部分。

相关习题:

Nico,a managing director in a derivatives group,expects to borrow$8 million at Libor in three months(90 days)for six months(180 days).She is concerned that interest rates may rise significantly over the next few months and hopes to hedge the risk.Lee,Nico’s colleague,advises her to enter into a forward rate agreement(FRA)expiring in 90 days on 180 days Libor.Assuming that the annualized 90-day Libor rate is 3.2%,and the annualized 270-day Libor rate is 4.5%.The forward rate set in the agreement closest to:

A.1.26%

B.3.83%.

C.5.11%.

查看答案+详细解析

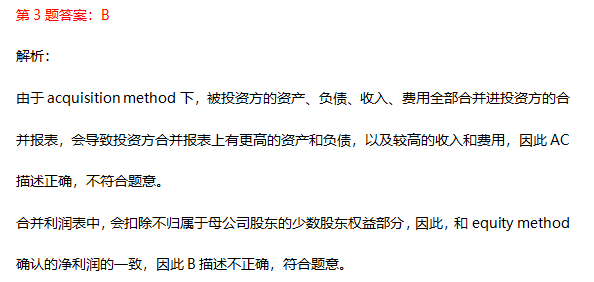

知识点3:不动产估值

关联科目及章节:另类-R35-不动产投资

考点介绍:

净营运收入是不动产毛收入扣减营运费用后税前去杠杆的收入

NOI=满租租金收入+其他收入(停车费)-控制成本与收账损失-营运费用,要能够运用直接资本化方法,根据NOI来对不动产进行估值。

知识复习:

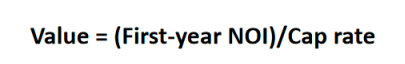

Value为不动产的价值,NOI1要用第一年的净营运收入,Cap rate是资本化率,即净营运收入资本化成价值所使用的比率

相关习题:

The Golden Property office building has a net operating income of$150,000 annually.A similar office building with a net operating income of$100,000 recently sold for$2,000,000.Using the direct capitalization method,the market value of Golden Property office building is closest to:

A.$3,000,000.

B.$3,625,000.

C.$2,500,000.

查看答案+详细解析

知识点4:在险价值VaR

关联科目及章节:组合-R40-衡量和管理市场风险

考点介绍:

在险价值指在假设的市场条件下,未来特定时期内预计在一定概率下发生的最小损失,也可以说是在一定置信水平下,某一金融资产或组合价值在未来特定时期内可能遭受的最大损失。

知识复习:

VAR的定义:以“one day 95%value at risk(VAR)of 10million”为例(两种理解)

1,一天之内,有5%的可能性损失至少为10million;

2,一天之内,有95%的可能性既会产生损失也会产生收益,如果是损失,则损失金额不超过10million。

相关习题:

Which of the following statements is least likely correct?

A.The time horizon of VaR is corresponding to calendar days rather than trading days.

B.5%10-day VaR can offer the information of the minimum loss.

C.The loss can be expressed as currency unit or percentage of the portfolio.

查看答案+详细解析

今天的知识你学会了吗?

别忘记,做例题加深印象哦!