今日学姐依旧帮大家征集了

学员考生反应的CFA知识高频考点

希望看到的人CFA都能

过过过过过过过过过

▼

CFA高频考点

1 汇率升值/贬值

关联科目及章节:经济-R14-汇率

考点介绍:

汇率的学习会贯穿CFA三个级别,而且会与衍生品投资、权益投资等学科产生联系,二级经济更是将汇率单独作为一个章节进行研究,需要考生在一级打下扎实的基础。

知识复习:

Base currency指的是基础货币,而平时说的汇率其实实质就是一单位基础货币可以兑换多少单位标价货币,比如人民币与美元汇率是8,意味着一单位美元换8单位人民币,而这个汇率如果增加50%变成12,也就意味着一单位美元现在可以兑换12单位人民币了,自然就是基础货币本身升值50%了。

相关习题:

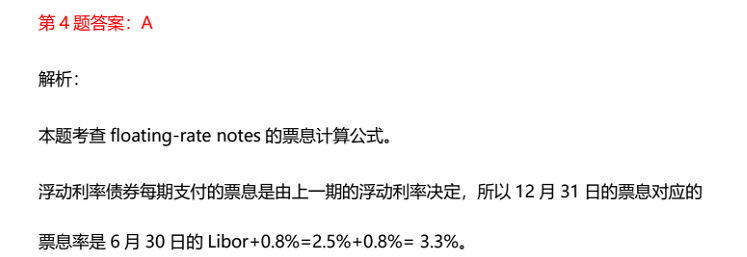

If GBP has depreciated 15%against EUR for the last 3 years,how much has the value of EUR been changed against GBP?

A.12%.

B.15%.

C.17.65%

查看答案+详细解析

2 区分EBIT与Operating income

关联科目及章节:财报-R17-利润表

考点介绍:

EBIT与Operating income属于利润表构成元素中比较容易忽视的一个小点,同时也会关联其他的章节(比如第20章比率)考察计算。需注意EBIT与Operatingincome并非完全一致。

知识复习:

EBIT指的是息税前收入,计算为EBIT=NI+Tax expense+Interest Expense。

Operating income指的是经营收入,Operating income=Net revenue-COGS-Operating expense。其中Opearting expense中常见的项目有SG&A。

我们还可以从Operating income进一步得出EBIT,即:

operating income

±Unusual or infrequentitems

+Other income

-Other expenses

=EBIT

相关习题:

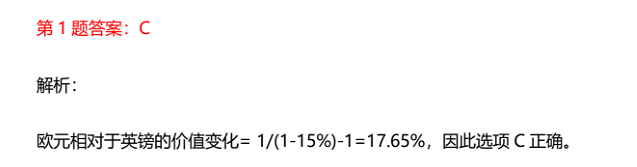

MG Co.,is a retailer.

The followinginformation relates to MG Co's income statement for last year:Revenue$100,000 Cost of sales$70,000 Selling,general&administrationexpenses$10,000

Other operating income$500

Gain on disposal of land$4500

Interest expense$10,000

Tax expense$10,000

MG Co's operating income is equal to:

A.$30,000

B.$20,500

C.$25,000

查看答案+详细解析

3 资本预算的基本原则

关联科目及章节:公金-R28-资本的使用

考点介绍:与资本预算相关的成本假设是第28章资本使用里的主要内容之一。考试常考哪些费用是属于完成项目所需要的成本,哪些不需要放入项目的资本分配假设里面。

知识复习:

可以算入项目里的成本记忆口诀如下:

“三要”是指要考虑Opportunity cost(机会成本),Externalities(外部性)和Tax(税收)

“两不要”是指不考虑sunk cost(沉没成本)和financing cost(融资成本)

相关习题:

Capital budgeting relies on several basic principles.BobTimothy makes the following statements:

Statement 1:Capital budgeting is based on the accountingconcepts such as net income or earnings before interest.

Statement 2:The cash flows are analyzed on the before-taxbasis.

Statement 3:Sunk cost and opportunity cost are bothincluded in the cash flow

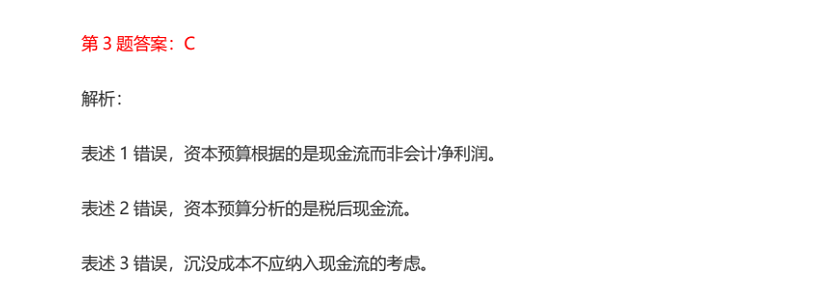

Which of the statement(s)is(are)correct?

A.Statement 1 and 2.

B.Statement 2 and 3.

C.None.

查看答案+详细解析

4 区分票息率和贴现率

关联科目及章节:固收-R39-固定收益证券简介

考点介绍:

固定收益证券科目的学习难度较高,许多考生觉得学习困难的核心原因在于基本概念理解不到位,这就要求我们在第一个章节就对票息、面值、价格、折现率等基本概念有所了解。

知识复习:

couponrate是票息率,是债券的名义收益率,等于票息/面值;

discountrare是贴现率,实质是真实收益率,反映了名义票息、购买价格、到期获取的本金综合暗示的收益率。

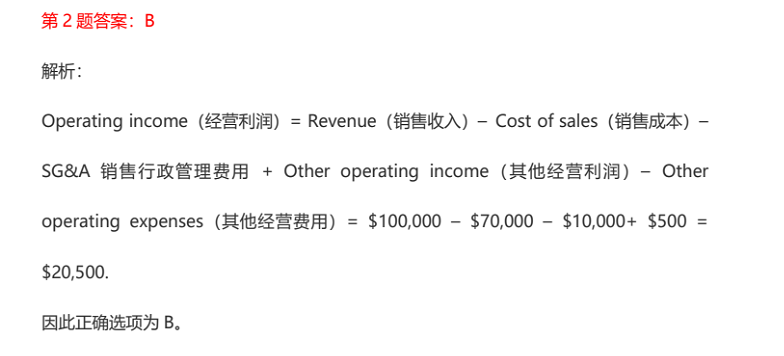

相关习题:

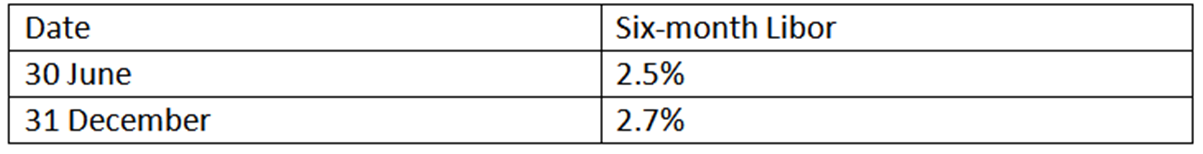

A mining company has issued a floating-rate note with acoupon rate equals to the six-month Libor plus 80 basis points.Bondholders canreceive the interest payment on 30 June and 31 December each year.Thesix-month Libor information is given below.What is the coupon rate for theinterest payment on 31 December?

A.3.3%.

B.3.4%.

C.3.5%.

查看答案+详细解析